Employees in Korea have to file their taxes by March 10. Though I learned to file my own taxes in the United States at an early age, I’ve never had to do this in Korea as our employers’ accounting offices always does it for us. If we wish to declare tax-deductions, however, it is our responsibility to turn in all necessary paperwork to our accounting offices ahead of time.

Sometimes, we miss those deadlines, which seems to be the case with a colleague of mine who messaged me the following question. I’m sharing my response in case it can be of help to someone else.

Dear Charles,

Do you know when this year’s time-frame for the declaration is? I have been waiting for messages from the University about it but yet nothing seems to have come . . .

My response:

The deadline for turning in documents for tax deductions is always in the middle of January. This year our accounting office accepted those documents from Jan. 15-19. It sounds like you missed that deadline, so our employer will have already filed your taxes for you but without deductions. If I understand your situation correctly, you should expect a smaller paycheck tan usual this month as you will probably have to pay a little extra tax.

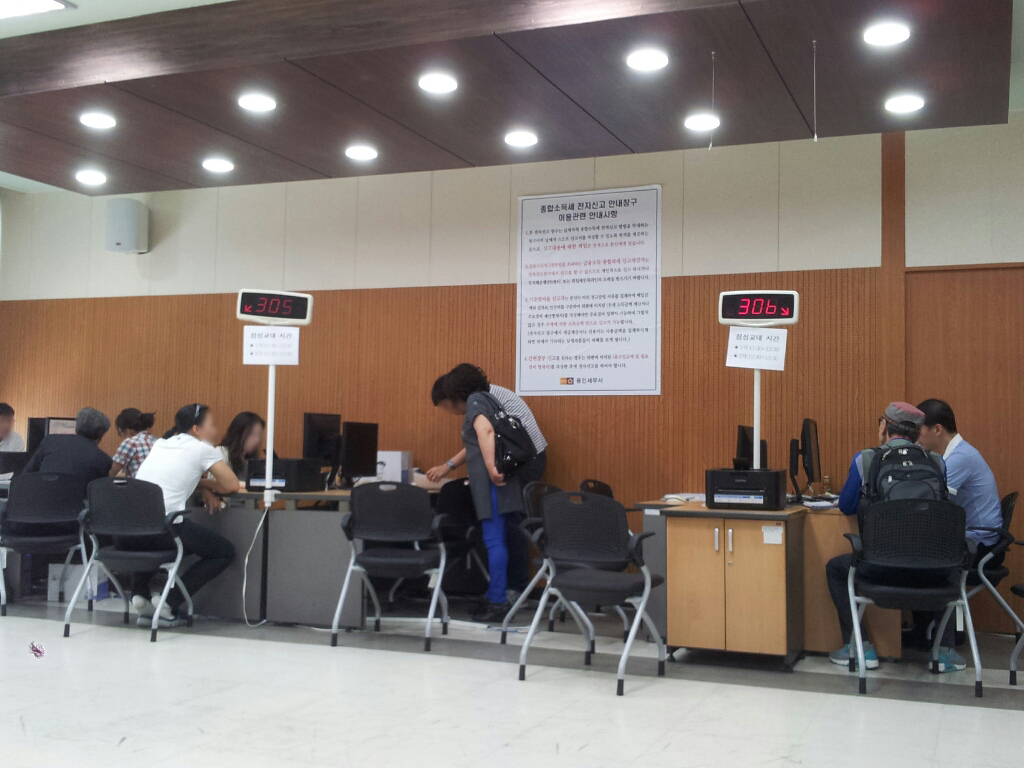

If this is so, don’t worry. In May (until the 31st), you can go to a local tax office (I go to 용인세무서) to add (추가 신청) deduction-related documents (spending related to insurance, credit card, education, etc — all can be obtained via the National Tax Service website). It’s pretty simple, and the level of Korean needed is not very high. Also bring a copy of your tax return along with any other tax documents declaring income from other sources. They will recalculate your taxes with your deductions. They will inform you that you either owe more tax or that you have a refund coming to you. After giving them your bank info, the refund will get processed within 2-3 months.

I hope that helps!

All the best,

Charles

I’m struck by the warm, personable tone of my response. It’s a wonder I don’t have more friends.

Leave a Reply